By John Ikani

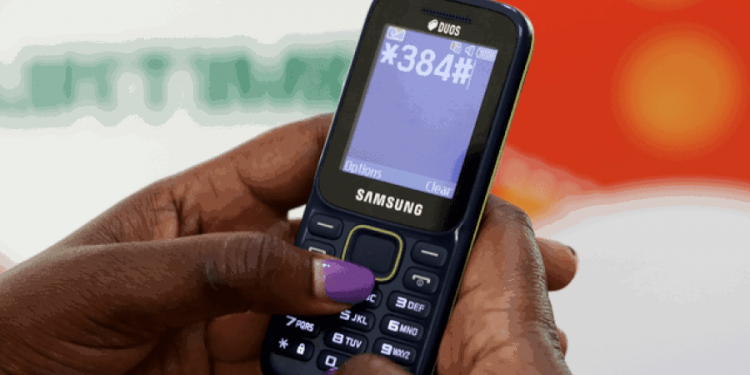

Banks in Nigeria have commenced deduction of a flat fee of N6.58 for every banking transaction carried out on all Unstructured Supplementary Service Data (USSD) banking platforms.

The banks in several circulars sent to their customers said a fee of N6.98 to their mobile network provider for every USSD transaction.

According to the circulars, the fee will be deducted by banks without any further recourse to the customers and remitted in full to the telecoms companies.

“This means that when you send money to anyone using USSD, a fee of N6.98 will be charged to your bank account, which is in turn remitted in full by your bank, to your mobile network provider,” the banks stated in almost similar circular.

It however noted that airtime and data purchases through USSD are exempt from this charge on USSD platforms.

The banks stated they have provided alternative platforms for customers in order to have free options for their electronic and digital banking transactions, including various self-service mobile banking apps.

“As our customer, we are making sure you have as many options as possible for all your financial transactions,” banks stated.

The notification of commencement of deduction of fee came after The Heritage Times reported that total debts owed by banks to telecoms service providers arising from the use of USSD had risen from N42 billion to N47 billion.

According to sources within the industry, banks had indicated that they were not ready to pay the debt while they continue to enjoy the service.

“The disconnection of the banks from our USSD platform is inevitable as we have now realised that the banks are not willing to pay the debt, which is accumulating every day and now over N47 billion “They want to continue to make money through our platforms and they are not ready to pay,” one of the sources said.

Background

Recall that Telcos had in April 2021 insisted that banks have to pay the N42 billion debt for the Unstructured Supplementary Service Data (USSD) and called for the intervention of the Central Bank of Nigeria (CBN) and the Nigerian Communications Commission (NCC) over the dispute.

Addressing the issue which came with a threat of disconnecting banks from using the service, Minister of communications and Digital Economy, Dr Isa Pantami on March 15, 2021, summoned a meeting involving representatives of mobile network operators, Association of Licensed Telecommunications Operators of Nigeria (ALTON), Association of Telecommunications Companies of Nigeria (ATCON), banks (represented by the Chairman, Body of Bank CEOs) and the sector regulators – Central Bank of Nigeria (CBN) and Nigerian Communications Commission (NCC). A statement issued after the meeting said there was a resolution that “effective March 16, 2021, USSD services for financial transactions conducted at DMBs and all CBN – licensed institutions will be charged at a flat fee of N6.98k per transaction.

This replaces the current per session billing structure, ensuring a much cheaper average cost for customers to enhance financial inclusion. This approach is transparent and will ensure the amount remains the same, regardless of the number of sessions per transaction.” Specifically, on the existing debt, which was put at N42 billion then, the statement, jointly signed by the Head, Corporate Communications, CBN, Osita Nwanisobi, and Director, Public Affairs, NCC, Dr. Ikechukwu Adinde, said: “a settlement plan for outstanding payments incurred for USSD services, previously rendered by the MNOs, is being worked out by all parties in a bid to ensure that the matter is fully resolved.”

No implementation of resolution amid rise in debts

However, telecom operators said nothing had been done to implement any of the resolutions months after.

“Nothing has changed after the meeting. The banks continue to use the USSD platforms without paying and the debt continues to mount. “We cannot continue this way, hence, we have decided to disconnect the banks. In fact, we would have disconnected them this week, but the NCC asked us to hold,” an official of one of the telecom operators said. Meanwhile, a few weeks after the joint meeting, the banks were reported to have claimed that they were not indebted to any telecom operators. “There is no such thing as an obligation due from banks to telcos,” Chief Executive Officer of Access Bank Plc, Herbert Wigwe, was quoted to have said at an investor call in Lagos.

“We chose not to make a public statement out of it because it is not appropriate for us to be found fighting with telcos in public,” he added. The telcos had earlier threatened to disconnect the banks from March 15, 2021, which prompted the meeting that led to the suspension. In a statement released through their umbrella body, the Association of Licensed Telecommunications Operators of Nigeria (ALTON), the telcos had said that the withdrawal of the service became inevitable as the banks have refused to pay their debts.

“Our members are initiating a phased process of withdrawal of USSD services, starting with the most significant debtors within the Financial Ser-vice Providers (FSPs) effective Monday, March 15, 2021. While the withdrawal of USSD service is in place, we encourage our subscribers to kindly explore alternative channels with their banks,” ALTON had said in a statement signed by its Chairman, Engr. Gbenga Adebayo.

According to Adebayo, it had been more than eight months since the NCC issued an updated pricing methodology for USSD services for financial transactions in Nigeria.

The methodology, he said, explicitly restricted mobile network operators from charging the end-user for the services and mandates the banking sector to enter into negotiations to settle outstanding obligations and agree on individual pricing mechanisms to be applied going forwards.

“During this time, mobile network operators have continued to provide access to USSD infrastructure and our members have continued to pay all bank charges and fees to access the banking industries assets and customers, despite the fact that obligations due from banks to telecoms companies for USSD services has reached over N42 billion,” Adebayo had said in the statement.