Experts, stakeholders and ordinary Nigerians have expressed concerns over the country’s rising public debt, Daily Times report.

The anxiety comes at a time when the country utilizes a large chunk of its revenue to service debts.

For instance, in the 2021Appropriation Act, the Federal Government budgeted N3.12 trillion for debt servicing out of a projected revenue of N7.89 trillion.

Similarly, in a report of budget implementation of the government which ended in December 2020, the total federal revenue earned by the in 2020 amounted to N3.93 trillion.

The figures mean that the federal government recorded a 27% drop from the target revenue of N5.365 trillion.

However, to the amusement of many experts and stakeholders, debt service for the year was put at N3.26 trillion which represents about 82.9% of the total revenue earned in 2020.

In another development, the Senate again approved fresh external loans of N1.02 trillion ($1.5 billion and €995 million) for the Federal Government.

This followed a letter written to the upper legislative chamber by the President in May last year to grant permission to borrow the said amount.

After considering the report of the Clifford Ordia-led committee on local and foreign debts, the loan request was approved on Wednesday, 21st April 2021.

The Daily Times understands that the €995 million loan will be utilized for agricultural mechanisation across the 774 LGAs.

The $1.5 billion loan is meant to fund critical infrastructure due to the huge impact of the COVID-19 pandemic across the 36 states and the Federal Capital Territory (FCT).

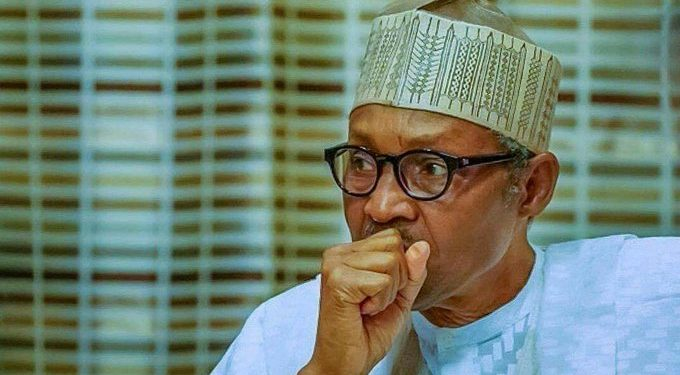

With the loan approval, The Daily Times can authoritatively report that the country under the leadership of President Muhammadu Buhari has now borrowed about N20 trillion without any viable plan for repayment.

Timeline of borrowings under Buhari

An analysis of rising debt under President Buhari by The Daily Times shows that the public debt stock of the country has risen from N12.118 trillion in 2015 when Buhari assumed office to N32.89 trillion in 2021.

This represents over 160% increase in public debt profile Official figures from the debt management office shows that Niigeria’s debt grew from N12.118 trillion in May 2015 to N12.6 trillion in December 2015,

In 2016, it jumped to N17.36 trillion, then N21.725 trillion in 2017, N24.387 trillion in 2018 and N27.401 trillion in 2019.

Subsequently, the figure went further to N29 trillion in the year 2020 Major funders of these loans include the World Bank, International Monetary Fund (IMF) Chinese Exim Bank and the African Development Bank (AfDB).

Only recently, the federal government sourced a $3.4 billion loan from the IMF, $2.5 billion from the World Bank, $1 billion from the AfDB, as well as N850 billion domestic capital market loans among others.No cause for alarm – DMO

Recall that the Debt Management Office announced that Nigeria’s public debt as at end of 2020 stood N32.915 trillion.

The DMO attributed the rise to the harsh economic challenges caused by the Covid-19 pandemic which has also forced advanced countries to increase their level of borrowing.

Nigeria’s public debt stock comprises that of federal and state governments as well as the Federal Capital Territory.

The DMO was however emphatic that the borrowing of the country was not under any threat as it was still within its limit.

“Total Public Debt to Gross Domestic Product as at December 31, 2020 was 21.61% which is within Nigeria’s new Limit of 40%.

The various initiatives of Government to increase revenues such as the Strategic Revenue Growth Initiative and the Finance Act, 2020, should help shore up Government’s revenue and reduce the Debt Service to Revenue Ratio,” the DMO added.

However, with the worsening economic situation, it will be difficult to align with the DMO’s assertion that Nigeria has no issue with borrowing.

For instance, due to the hike in prices of food items, the country’s inflation rate rose to 18.17 per cent in March 2021, from the 17.33 % recorded in the previous month, according to the National Bureau of Statistics.

This indicates that the country hasn’t had it this bad in the last four years as the figure remains its worst Inflation rate.

In the same vein, unemployment reached 33 per cent in the last quarter of 2020, putting the country among the highest in the world.

Additionally, many states have not implemented the minimum wage of N30,000.

Adding to current concerns, the federal government had also indicated interest to sell some critical national assets to fund its budget.

It also plans to borrow from dormant bank accounts through the provisions of the Finance Act 2020.

Reacting to the high rate of borrowing, a finance analyst and President, Association of Capital Market Academics, Prof. Uche Uwaleke, said to an exteny, the borrowings are justified if they are being appropriated for.

“It’s ok if it’s part of what is already provided for in the 2021 budget. Recall that the current year’s budget has a deficit of over N5 trillion to be financed largely by domestic and foreign loans,”

In a chat with The Daily Times, he said: “I think the approval by the Senate is in consonance with the procedure for taking foreign loans.

The concern should be more on the source and terms of the loan as well as the use to which they are put.

“That the loan is tied to agric mechanization and infrastructure development is comforting due to its positive multiplier effect on the economy.

Having approved such foreign loan, it behoves on the National Assembly to monitor its disbursement and application in order to ensure that it is used for the purpose for which it is meant.”

However, another expert, Mr. Suleiman Musa, tends to disagree with the initial position of Uwaleke.

He said: “It is highly troubling to see that our borrowings have amounted to this in just about six years. How do we repay all these loans without a definite national plan?

“We all know there is trouble when we use almost 80% of our revenue to service debts.

It is not just feasible, “As such, the government must look for other means of augmenting the budget or even borrow locally than going to borrow foreign loans with huge interests.”

HIGHLIGHTS OF PUBLIC DEBT STOCK UNDER BUHARI 2015 TILL DATE

2015 – N12.6 trillion

2016 – N17.36 trillion

2017 – N21. 72 trillion

2018 – N24.38 trillion

2019 – N27.40 trillion

2020 – N29.1 trillion

2021 – N32.89 trillion

MAJOR FUNDERS

World Bank

International Monetary Fund

China Exim Bank

African Development Bank

DEBT SERVICING FROM 2015 TILL DATE

2015 – N935 billion

2016 – N1.47 trillion

2017 – N1.84 trillion

2018 – N2.01 trillion

2019 – N2.14 trillion

2020 – N2.53 trillion

2021 – N3.12 trillion