By Olusegun Adeniyi

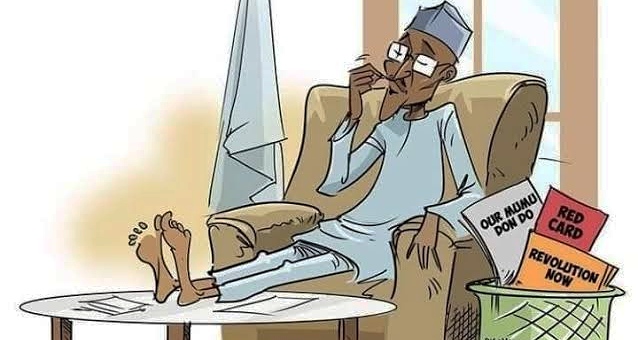

During his campaign for a second term in January 2019, President Muhammadu Buhari chose to rouse the Ibadan, Oyo State crowd with an unusual chant that has since gone viral. The All Progressives Congress (APC) slogan is ‘Change’ so when the president raised his fist and shouted the name of his party, the crowd responded appropriately. But apparently not satisfied with the response, Buhari decided to try something new. “APC…”, he chanted but before the crowd could respond, he added, “From top to bottom!” And for emphasis, the president repeated both the chant and response: “APC…from top to bottom.” By the third time, the crowd joined him in proclaiming “from top to bottom.”

Handlers later explained that the president meant his party would win all elective offices “from top to bottom”. But opposition politicians have since argued that Buhari meant he would take the country “from top to bottom”. Last September, Benue State Governor, Samuel Ortom, alluded to the video when his spokesman, Nathaniel Ikyur, said “They (APC) have kept their promise to take Nigeria from top to bottom. They have taken our country beneath the bottom.” And with barely ten weeks to the end of Buhari’s tenure, not a few Nigerians also believe that the president has indeed “fulfilled that pledge” made four years ago in Ibadan.

For those who share this school of thought, nothing demonstrates the “prophetic declaration” better than the Naira confiscation policy of the Central Bank of Nigeria (CBN) that has destroyed the lives and livelihoods of millions of Nigerians. The president not only owned the policy but defended it vigorously. On reflection, I fail to understand why, even when both the National Council of State and the Supreme Court offered face-saving opportunities for the president to change course last month, they were ignored. Whatever may have been the intended benefits of the policy (and I endorse the idea behind it), systemic inadequacies that make life difficult for the ordinary people should have compelled a rethink of its implementation. Despite public outcry, both the presidency and the CBN arrogantly carried on until the intervention by the apex court. Meanwhile, it was not lost on Nigerians of a certain generation that a similar policy implemented by Buhari as military Head of State four decades ago ended in disastrous consequences.

One of the charges against Buhari is that he cannot see beyond “northern interest”. But as I always argue in his defence, the president doesn’t even understand those interests. Otherwise, he would not have signed on to this policy that has almost rendered the entire northern region prostrate. Myopic (and sometimes insensitive) appointments of friends, associates, relations, and in-laws to ‘juicy’ positions without due regard for equity and diversity in a pluralistic state cannot substitute for targeted and strategic interventions that would give more meaning to the ordinary people in the north. A few weeks ago, I visited former Defence Minister, Alhaji Lawal Batagarawa (who also hails from Katsina State). He shared with me revealing anecdotes of the damage the Naira confiscation policy has done to most rural people in the North. If the president cared enough, he would have been aware of the agonies of people in most northern communities because of the policy.

On Monday the president practically threw the CBN Governor, Godwin Emefiele under the bus by saying the apex bank had no reason not to comply with a recent Supreme Court order on the pretext of waiting for his directives. According to his spokesman, Garba Shehu, the president never told the Attorney General of the Federation (AGF), Abubakar Malami and the CBN Governor to disobey any court order. Shortly after that presidential proclamation, the CBN released a statement that in deference to the Supreme Court judgement of 3rd March (which it had ignored) the old N200, N500 and N1000 notes would remain valid till 31st December 2023. But the damage has been done.

When the policy was first announced about six months ago, there were signals that the CBN ought to have picked up on, including those from unlikely quarters. Quite naturally, the World Bank endorsed the policy which ordinarily would promote transparency and accountability, especially in the management of public finances. But the Bank also warned that the short transition period may have negative impacts on economic activity for the poorest households. “International experience suggests that rapid demonetizations can generate significant short-term costs, with small-scale businesses, and poor and vulnerable households, potentially being particularly affected due to being liquidity-constrained and heavily reliant on day-to-day cash transactions,” according to the World Bank. “At present, households and firms already face elevated financial pressures from prolonged, high inflation, recently compounded by external food and fuel price shocks, and the severe floods, and phasing out existing naira notes over a short time period may add to their challenges.”

I doubt if the CBN paid attention to that warning and others by economists within the country who expressed concerns. Their voices were drowned by those who, for political reasons, hailed the president while disregarding the timing of the policy and problems associated with implementation. “People with illicit money buried under the soil will have a challenge with this but workers, businesses with legitimate incomes will face no difficulties at all,” Buhari reportedly said in a statement by his spokesman. It put paid to speculations about the ownership of the policy. From that moment, opposition politicians latched on by selling the policy as being against vote buyers in a country where the mob rules. Since nobody would like to be associated with endorsing political corruption on the eve of a crucial general election, we all waited for the ruse to unravel – as it has now done.

Last week, the Centre for the Promotion of Private Enterprise (CPPE) estimated that the economy has lost about N20 trillion to the naira scarcity. “Nigerians have not been this traumatised in recent history. The economy is gradually grinding to a halt because of the collapse of payment systems across all platforms,” according to the CPPE Chief Executive, Muda Yusuf. “Digital platforms are performing sub-optimally because of congestion; physical cash is unavailable because the CBN has sucked away over 70 percent of cash in the economy; and the expected relief from the supreme court judgement has not materialised. The citizens are consequently left in a quandary.”

Left in a quandary does not capture the harrowing experience of millions of Nigerians in the past two months. From schools to offices and hospitals, there is no sector that has not felt the negative impact of the policy. In one case, a pregnant woman reportedly died after her husband failed to get cash in time to pay for her admission to a health centre. There are similar fatalities in many hospitals and health facilities across the country. The situation is worse in rural communities where few have access to bank accounts or the required mobile phones and internet for such transactions. Even in urban centres, people had to resort to trekking long distances and in the process many, including a journalist in Ibadan, died.

Petty traders were the worst hit in an economy driven by the informal sector. Many could not make sales because their customers didn’t have cash to pay. Market people selling perishable food items like tomatoes, pepper, fruits etc. have distressing tales to share of how those products ended up in refuse bins. In desperation, some have been forced to accept prices far below what they paid to purchase the commodities. Newspaper vendors, roadside sellers of maize, plantain, yam etc who barely eke out a living have been sent out of business. Mechanics, vulcanizers and other artisans have become destitute as Point of Sale (PoS) operators make a killing from the misery of others because bank transfers hardly work. That has led to people standing surety for customers in legitimate transactions while trade by barter has been reintroduced in the country. Currencies of neighbouring countries have also become legal tender in some parts of the country.

With Nigerians spending hours (some, days) queuing at bank ATMs in search of Naira notes, productivity has dropped in the past two months. Foreign correspondents in Nigeria no longer look for stories as they witness the deprivation and desperation of our people. “Customers are waiting all day at banks and ATMs to withdraw only enough money — called naira — to last a day. Fights have broken out in bank halls; angry customers have attacked workers and protesters have set financial institutions on fire,” according to a report in the globally respected American not-for-profit news agency, Associated Press (AP). “Businesses unable (to) carry out transactions have been forced to close, and people are illegally selling new currency notes at higher rates.”

The banking industry has also suffered collateral damage with the doors of many commercial banks closed to customers for the past few weeks. Besides, no fewer than 17 bank branches were attacked by protesters last month with an estimated loss put at about N5 billion by the Association of Senior Staff of Banks, Insurance and Financial Institutions President, Oluwole Olusoji.

A former statistician general of the federation, Dr Yemi Kale who was last week appointed as partner and chief economist at KPMG Nigeria, has waded in on the cost-benefit analysis of the policy vis-a-vis implementation. He estimates a reduction in the 2023 first quarter nominal GDP of our country by between 10 to 15 trillion Naira due to the challenges of sourcing cash. “This is because about 40% of Nigeria’s N198tn GDP in 2022 is informal of which about 90% is cash based. Further 30% of formal sector GDP is cash based. This means N106.9tn of total GDP is cash based,” Kale wrote in a Twitter post on Tuesday, highlighting the damage implementing the policy has done to the economy.

Unfortunately, not a few people saw this coming. In a Policy Insight paper, ‘Naira Redesign Policy: Of Faulty Assumptions, Systemic Risks and Way Out’, published last month, Agora Policy, an Abuja-based think tank highlighted salient issues, using statistics from the World Bank, International Monetary Fund (IMF) and the National Bureau of Statistics (NBS). Nigeria, according to the Waziri Adio-led Agora Policy, has one of the lowest currencies in circulation relative to the Gross Domestic Product (GDP) in the world. Whereas currency in circulation relative to GDP is 20 percent in Japan, 9 percent in China, 7.5 percent in the United States and 3.5 percent in the United Kingdom, it is 1.67 percent in Nigeria. “It can be safely assumed that the point of cash is for it to be in circulation and not sitting in bank vaults,” Adebayo Ahmed, the economist who wrote the report stated while highlighting the paradox of a largely informal economy being driven without cash.

At the end, what is particularly noteworthy is that the people who fought Buhari on this ill-conceived policy are his own party men, including the APC candidate and now president-elect, Bola Ahmed Tinubu and Kaduna State Governor, Nasir El-Rufai. Not only have they prevailed, but they have also exposed the president to the charge of lawlessness that will remain on his record. In the judgment delivered by Justice Emmanuel Agim, the apex court held that Buhari breached the constitution in the manner he issued directives to the CBN for the Naira redesign without consultation with relevant stakeholders. Besides, “The disobedience of orders of courts by the President in a constitutional democracy as ours is a sign of the failure of the constitution and that democratic governance has become a mere pretension and is now replaced by autocracy or dictatorship,” according to Justice Agim. This is a serious indictment on any democratically elected leader and a permanent stain on Buhari.

In my 9th February column, I used a Yoruba adage, “Òrìṣà bí o le gbè mí, se mí bi o se ba mí” (‘Deity, if you cannot improve my material condition, please do not worsen my plight’ or more appropriately, ‘please, leave me as you met me’) to illustrate how many Nigerians feel today about the current administration that is on its way out. “While Nigerians have for decades been conditioned to buying fuel in the black market due to the way we mismanage our affairs, things are currently so bad that we are using money to buy money (Naira notes) to enable us to queue for fuel and pay for other services,” I wrote. “Meanwhile, online payments are not working effectively at a time the system is supposed to have gone cashless!” I also reported on how Nigerians were going ‘pantless’ and ‘braless’ in banking halls to demonstrate their desperation. “Even if we concede the fantasy that this whole thing was orchestrated to checkmate vote buying, punishing ordinary people for the sins of politicians is multiple jeopardy.” I ended the piece with the admonition of Reuben Abati in his column earlier that week: “The minimum that President Buhari is obliged to do is to leave this country as he met it – a civilian democracy, even if badly wounded.”

Technically, the CBN Naira confiscation policy has been reversed by the apex court. But the cost is enormous. Not only because of what has been lost but also because of other consequences. In Nigeria, when you create incentives for bad behaviour in the public arena, the problem hardly goes away. I hope the CBN has not created a new industry for Naira cash sellers within the banking industry and their collaborators who could still make life difficult for the ordinary people in pursuit of illicit gains. Right now, cash is unavailable because the CBN is yet to release the N500 and N1000 notes it had mopped up. Hopefully, things will ease in the coming days and weeks as they work out modalities for the reinjection of cash to the system. But whatever happens, many Nigerians will not forget the experience of the past two months in a hurry.

Those who argue that President Buhari has fulfilled his campaign promise to take Nigeria “from top to bottom” have a point. When people who have millions of Naira in their bank accounts begin to share “testimonies” of how they were “fortunate” to buy N50,000 cash for N70,000 to resolve a life-and-death situation, the only logical conclusion to draw is that Nigeria has reached rock bottom!

• You can follow me on my Twitter handle, @Olusegunverdictand on www.olusegunadeniyi.com