Last November, Urs Rohner, the chairman of the board of Credit Suisse, had a party at a Zurich restaurant to celebrate his 60th birthday. Among the scores of friends, family and business associates who gathered, attendees say, there was a single Black guest: Tidjane Thiam, the bank’s chief executive.

The festivities had a Studio 54 theme, with 1970s costumes and hired entertainers. Mr. Thiam watched as a Black performer came onstage dressed as a janitor, and began to dance to music while sweeping the floor. Mr. Thiam excused himself and left the room. His partner and another couple at his table, including the chief executive of the British drug company GSK, followed.

Eventually they returned to the party, only to be astonished again. A group of Mr. Rohner’s friends took the stage to perform their own musical number, all wearing Afro wigs. (Mr. Rohner declined to comment on the events, which were described by three guests.)

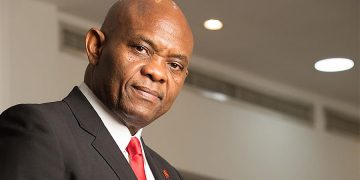

For Mr. Thiam, now 58, the party was just one in a series of painful incidents that shaped his five years atop Credit Suisse, when he was the only Black chief executive in the top tier of banking. Some moments were shocking, others disturbing; most had to do with tensions around being Black in a predominantly white industry and an overwhelmingly white city.

A tall, reserved, bespectacled polyglot, Mr. Thiam did the job he was hired to do: He made Credit Suisse profitable again after a long decline. But he never had to stop fighting for acceptance and respect, both within the bank and in Switzerland generally. At a shareholders meeting, his background was denigrated as “third world.” A subordinate purchased the home next to his, which was taller and looked directly into Mr. Thiam’s windows. The Zurich press rode him for not appearing sufficiently Swiss.

Now the number of Black chief executives at the highest level of banking is back to zero. In February, Credit Suisse’s board forced Mr. Thiam’s resignation, after a deeply embarrassing surveillance scandal erupted on his watch. When Mr. Thiam’s No. 2 admitted he had ordered investigators to spy on employees, the chief executive found himself with few allies and no leverage to survive.

His ouster attracted remarkably little notice outside Zurich, coming as it did months before a global reckoning with systemic bias, and occurring 4,000 miles from Wall Street. But interviews with 11 people who worked closely with Mr. Thiam at Credit Suisse, and five other close contacts — including clients, friends, family and investors — suggest that race was an ever-present factor throughout his tenure, and that it helped create the conditions for his startlingly swift departure.

Whether it’s labeled racism, xenophobia or some other form of intolerance, what’s clear is that Mr. Thiam never stopped being seen in Switzerland as someone who didn’t belong.

After Mr. Thiam’s resignation, he gave a news conference at the bank’s headquarters. “Every second, I’ve done the best I could,” he said. “I am who I am. I cannot change who I am.” He added: “It’s the essence of injustice to hold against somebody what they are.”

‘The most important thing in life is not to die’

Tidjane Thiam (pronounced tee-JOHN tee-YAHM) was born in Ivory Coast to an elite family active in politics. One relative led the country’s successful bid for independence from France in 1960 and became its first president. Another became the prime minister of Senegal.

The youngest of seven, Mr. Thiam was raised Muslim. His mother, Marietou, could not write but parented with perfectionist standards. “Be gallant, respect the staff that worked for us — on this, she was ruthless — do not lie, be punctual, do not say bad words, show solidarity,” said Yamousso Thiam, Mr. Thiam’s youngest sister, in an interview.

Their father, Amadou, was a journalist, a cabinet minister and an ambassador to Morocco. When Mr. Thiam was an infant, Amadou was incarcerated for three years on charges of plotting against the Ivorian government. The allegations were later invalidated, and the Thiam children would long remember the injustice — as they did the lesson their father took from narrowly surviving a coup attempt in 1971, with a gunshot wound to the hand. “The most important thing in life,” Amadou would joke, “is not to die.”

When Mr. Thiam was 6, and conspicuously uninterested in school, one of his brothers asked the Ivorian president to intervene. He summoned Mr. Thiam and his parents and reamed them out. “I remember it as if it were yesterday,” Mr. Thiam recalled in a 2015 interview. “There was a kind of family court, where there was an indictment: ‘He must go to school. The era of illiterate African princes and lazy kings, it is over.’”

Mr. Thiam quickly excelled, and in 1984 he became the first Ivorian to graduate from Paris’s prestigious École Polytechnique. After earning a degree in engineering and a master’s in business, Mr. Thiam worked at the World Bank, then in the Paris office of McKinsey.

In 1994, Mr. Thiam returned to Ivory Coast to work in public service. A few years later, he was promoted to minister of planning and development — but when a military coup deposed the president, he refused a role in the new government, and, fearing for his life, he returned to Europe and the private sector.

He ran the European operations of Aviva, a British insurer, and in 2009 was named chief executive of the British financial services firm Prudential — the first Black person to run one of the London Stock Exchange’s hundred largest companies. During his tenure, Prudential’s profits doubled and its stock price tripled, and a BBC host described Mr. Thiam as having “soared through top-flight institutions with a heady cocktail of crystal-clear intellect, fizzing ambition, and a healthy dash of charm.”

Mr. Rohner, the chairman of Credit Suisse, approached Mr. Thiam about the possibility of running the bank in 2014. Mr. Thiam was skeptical, he later told Euromoney magazine: It was a daunting role, and he wasn’t sure the bank was serious about hiring him. (Earlier in his career, he’d told a headhunter that he wouldn’t travel for a job interview unless the prospective employer knew he was “Black, African, Francophone and 6 foot 4.”) He insisted on lengthy discussions with Mr. Rohner before agreeing to take the job.

“The chairman tells me we had 19 meetings,” Mr. Thiam said in the Euromoney interview, adding: “I actually said no twice.”

‘Sink down to the third world’

At the time, Credit Suisse was in a deep funk. Years after the financial crisis, it was still heavily dependent on costly trading strategies, and its wealth management unit trailed UBS, the bank’s archrival in Zurich. Investors were impatient with its languishing stock price. On the March 2015 day when Mr. Thiam’s hiring was announced, Credit Suisse shares rose 7 percent.

His restructuring plan involved thousand of layoffs and paring back sales and trading, making many employees nervous for their jobs. It was an executive he promoted, however, who gave Mr. Thiam one of his first unsettling experiences in Switzerland.

To bolster Credit Suisse’s private wealth management business, he had tapped Iqbal Khan, 39, who had been born in Pakistan but moved to Switzerland as a child. The two were discussing strategy one day late in 2015, according to people familiar with the incident, when Mr. Khan announced that he’d bought the house next door to Mr. Thiam’s in Herrliberg, a suburb with lofty prices and views of Lake Zurich. Mr. Thiam asked Mr. Khan if he was serious. Mr. Khan said yes.

Later, Mr. Thiam told friends and colleagues that the news disturbed him. Fiercely private, he was going through a divorce, and he was leery of a subordinate having a view of his low-slung property. As a C.E.O., he didn’t relish the idea of being literally looked down upon.

Mr. Thiam made an effort to embrace Zurich society. He visited Swiss business leaders, spoke on panels convened by Swiss media and attended an annual spring festival in traditional Swiss garb: a Napoleon-style hat and matching navy cloak. But before long, aspects of his lifestyle began to irritate the locals. With Credit Suisse making a show of cutting costs, the Swiss press began to catalog Mr. Thiam’s first-class air travel and stays in presidential suites. One column accused him of taking helicopters to events and traveling with an entourage, calling him “King Thiam.”

In a country nearly synonymous with wealth — the home of the Swiss bank account and six-figure wristwatches — such anti-elitism is a little difficult to parse. Expatriates who have long worked in Switzerland say the Swiss have a fine-grained aversion to public displays of wealth, and regard those who flaunt it as outsiders. One foreign billionaire in the country, who did not want to be named discussing the issue, said he had banned luxury cars from his company garage.

Others were more direct about labeling Mr. Thiam an outsider. At Credit Suisse’s annual investor meeting in 2016, a shareholder named Ingeborg Ginsberg, a 94-year-old Holocaust survivor, questioned Mr. Thiam’s background.

“The bank is called Suisse — Credit Suisse,” Ms. Ginsberg said in German. Referencing Brady Dougan, Mr. Thiam’s American predecessor, she added: “I asked him last year if he doesn’t have a conflict of interest. I ask the same question of Mr. Thiam, if he can understand me: Does he not have a conflict of interest? I heard him mention the third world — is that really what we want? That a good, solid, Swiss bank sinks to the level of the third world?”

On the dais, where Mr. Thiam sat next to Mr. Rohner, their shock was evident.

Mr. Rohner interrupted. “You should not make such accusations, without declaration, into the room,” he said, adding: “We do not always take foreigners, we always choose the best man for the job, and we have found that man.”

By 2018, Credit Suisse’s business had improved substantially. The bank was again solidly profitable, and the wealth division had overtaken UBS in some areas. Mr. Thiam had resolved legal issues that preceded his tenure, settling a major U.S. case for an amount less than Credit Suisse had expected. Euromoney named him banker of the year.

Mr. Thiam was by now well-known in Zurich, where pedestrians on the Bahnhofstrasse would sometimes shake his hand or ask for selfies. Much of the attention was innocuous, but people who worked with him at the time say the constant exposure wore him down.

In predominantly white Zurich, a city of just 400,000, his powerful role and his skin color made him stand out. Mr. Thiam stopped driving his Porsche Cayenne to work, fearing that any run-in with another motorist, even over a parking spot, would turn into a media incident. On the tram, his adult sons were often the only Black riders — and the first to be asked for their tickets. Merely by appearing at a local nightclub, they could trigger gossip. Mr. Thiam felt that he was under a microscope; when his sister planned a surprise visit, an overeager Zurich hotel worker noticed her booking and shared the details with Mr. Thiam’s office, ruining the occasion.

At another point, during a business trip from Zurich to Geneva, he was held up by a customs worker who demanded to see his passport, even after Mr. Thiam protested that he was traveling within Switzerland. He produced the document and was permitted to leave the airport, but instructed a staffer to lodge a formal complaint about the experience. (Each of these incidents was described by multiple people.)

Things were beginning to sour inside Credit Suisse, too. Despite an improved balance sheet, Credit Suisse’s shares were down, hurt by stock offerings Mr. Thiam had deemed necessary to strengthen capital reserves. He told associates he felt underappreciated by board members, some of whom faulted him for Credit Suisse’s lack of growth in China.

In August 2018, a local financial publication wrote that Mr. Thiam was “feted abroad, unloved in Switzerland,” adding: “Prone to imperious behavior and prickly to criticism, Thiam has lost grasp of the Swiss sense of proportionality.” News articles often drew belittling comments. One reader of an especially critical Zurich blog called him a “fruit salesman” and added, “Go home, fool!” Another wrote: “I hope he sends his money home. Then we can classify it as development aid.”

Mr. Thiam would often say that given his family’s brushes with military insurrections, he wasn’t bothered by bad press and corporate drama. But as the year wore on, Mr. Thiam confided to associates his fear that the board wanted him out. Their unspoken message, he said, was: You cleaned up the mess. Now leave. It’s a pattern known as the “glass cliff” — the tendency of institutions to install women and minorities as leaders only when there’s big trouble, and then shunt them aside.

Mr. Thiam was closer to the precipice than he knew. In early 2019, he hosted a holiday party at his home. Mr. Khan had by then moved in next door, and Mr. Thiam had planted trees to obstruct the view. At the party, Mr. Khan got into a heated discussion with Mr. Thiam’s partner about the landscaping, upsetting her, and the two men stepped downstairs for a private word. Mr. Khan quickly left the scene.

Neither executive will say exactly what transpired. But later that year, Mr. Khan shocked Zurich by decamping to UBS. Wealth management had been the most successful aspect of Mr. Thiam’s tenure, and now his star executive would be working for the bank’s biggest competitor.

Spy games

That September, Mr. Khan and his wife were driving to lunch at a Zurich restaurant when they noticed they were being followed. Mr. Khan parked and confronted the man, who turned out to be a detective from a Swiss firm called Investigo. An argument ensued, during which each party has since accused the other of becoming physically aggressive. Mr. Khan filed a police report, and both Credit Suisse and the canton opened investigations.

“Spygate,” as the Swiss media called it, was a sensation. At Credit Suisse, the chief operating officer, Pierre-Olivier Bouée, admitted to ordering the surveillance, saying he had suspected Mr. Khan of trying to poach employees. He resigned. Mr. Thiam, who denied any knowledge of the spy games, was cleared. But Mr. Bouée was not just his No. 2; he had followed Mr. Thiam to the bank from Prudential, and the chief executive’s name was deeply tarnished by association.

The incident was a debacle for all of Credit Suisse, an institution that was a source of great national pride. A contract worker who had been involved in hiring Investigo died by suicide. Mr. Rohner felt obliged to publicly apologize to the Khans and the Swiss public.

Soon, more accusations surfaced, including that Credit Suisse’s H.R. chief had also been surveilled. Late in December, the Swiss Financial Market Supervisory Authority — known as Finma — started an inquiry into Credit Suisse’s use of investigators to monitor employees.

The repercussions of the scandal progressed with remarkable speed. On Jan. 31, 2020, Bloomberg reported that Mr. Rohner was looking for a new chief executive.

Three large shareholders — two American, one British — publicly came to Mr. Thiam’s defense. David Herro, a top executive at Harris Associates, a Chicago fund, suggested that the opposition to Mr. Thiam was racially motivated. Appearing on Bloomberg Television, Mr. Herro attributed the strife to “envy from competitors — or perhaps something else, given that Mr. Thiam looks a little bit different than the typical Swiss banker. Either one of these two rationales behind these attacks against him, to me, are extremely distasteful.”

But Mr. Thiam had too little support in his corner. On Feb. 7, he resigned. A Swiss member of his executive team was named his successor.

As chief executive, Mr. Thiam was responsible for everything at Credit Suisse, and the surveillance activity was widely viewed as despicable. But it’s an open question whether a C.E.O. from a different background might have survived. Other bank leaders have dodged far greater scandals.

In 2012, Jamie Dimon, the chief executive of JPMorgan Chase, failed to rein in a trader, nicknamed the London Whale, who lost the bank more than $6 billion and triggered more than $1 billion in fines. Last week, in a different matter, the bank agreed to pay nearly $1 billion in fines for illegally manipulating the markets for precious metals and Treasury products. Mr. Dimon remains Wall Street’s longest-serving C.E.O.

In 2016, in a case with striking similarities to what transpired at Credit Suisse, the chief executive of Barclays tried to unmask a whistle-blower, at one point asking an internal security team to intervene. British regulators fined the C.E.O., James E. Staley, with little fanfare. Separately, in 2019, Mr. Staley was revealed to have had ties to Jeffrey Epstein, the financier accused of sex trafficking young girls, including a visit to Mr. Epstein while he was incarcerated. Mr. Staley is still at the top of Barclays.

Before he departed Credit Suisse, Mr. Thiam had a chance to present his final set of earnings results to the press. Toward the end of the question-and-answer session, a local reporter spoke up.

“The strategy was good,” the reporter said, but the style “did not speak to Swiss mentality. This is my question: Would it be different in England or another —”

“I am who I am,” Mr. Thiam interrupted. “The same way I was born with a right hand, I cannot change being right-handed.” He added, “If people don’t like right-handed people, then I’m in trouble. That’s all I can say, because I can’t become left-handed.”

Colleagues sitting near him swore they saw Mr. Thiam’s eyes glistening.

The investigation continues

Mr. Thiam remained in Zurich, awaiting a formal interview with Finma. It was a time of anguish, say close associates, because he urgently wanted to visit his son, Bilal, who was suffering from cancer in a Los Angeles hospital. Late in April, he flew to Bilal’s bedside. He died in early May, at 24.

Since then, Mr. Thiam has been consulting on virus relief efforts in Africa, where he serves as special envoy of the African Union on Covid-19. He has also re-engaged with politics in Ivory Coast. In August, Mr. Thiam stoked rumors that he was considering a presidential bid with a video message commemorating the country’s 60th year of independence, in which he urged Ivorians to embrace a “reconciled and fraternal” spirit.

On Sept. 2, having concluded that Credit Suisse’s surveillance activities may have violated Swiss “supervisory law,” Finma announced that its inquiry had been escalated from an investigation to an enforcement matter. An agency spokesman said that the focus was on the bank itself, not individuals.

For his sister Yamousso, one question about the Swiss still lingers. “I would be curious to know,” she said, “if today they’d finally have the honesty to recognize that seeing a Black man at the top of one of their most prestigious companies was unbearable.”